With Cigna Global Health Options you can create a health insurance plan that’s perfectly meet the needs of you and your family. Cigna Global plans provide peace of mind for customers in over 200 countries worldwide.

Cigna Global is optimal for;

✔ Businesspeople who is continuously traveling

✔ Nomad Workers

✔ Expats to the U.S. and North America

✔ Residents in developing countries where there is no adequate local health insurance

✔ those who have problems having local health insurance

✔ Perpetual Traveler

and can be insured up to 100 years old !

■ Get Quote in 3 minutes

Premium vary with your age, country to stay and plan. You can check monthly premiums in 3 minutes.

get Quote in 3 minutes

■ until 3 years of stay in foreign countries

If you stay less than 3 years in foreign countries and prefer to have affordable health insurance, the following is for you.

▷ Care Discover from 1.39€/day including liability insurance

Details of Cigna Global are below ↓

Contents

Why Cigna Global ?

Cigna Global has 86 million customer relationships in over 200 countries and jurisdictions. Looking after them is an international workforce of 37,000 people, plus a medical network comprising of over 1 million partnerships, including 89,000 behavioural health care professionals, and 11,400 facilities and clinics.

Create your Plan

Creating a comprehensive, tailored plan with Cigna is simple. It’s flexible, so you can choose and pay for only the cover you need.

Cigna plans comprise of three levels of cover: Silver, Gold and Platinum. Each plan includes International Medical Insurance. Choose from two areas of coverage, depending on needs and location: Worldwide including USA and Worldwide excluding USA.

In addition, you can select optional modules, including: International outpatient; International Medical Evacuation; International Health and Wellbeing; and International Vision and Dental which enables you the flexibility to create a health insurance plan that suits your unique needs.

As well as this, we offer a wide range of cost share and deductible options on International Medical Insurance and International Outpatient, allowing you to tailor a plan to suit your budget.

1. SELECT YOUR CORE PLAN

Start with one of core inpatient plans, which covers you for essential hospital stays and treatments, such as:

> Surgeon & consultation fees

> Hospital accommodation

> Cancer treatment

Choose from two areas of coverage:

> Worldwide including USA or

> Worldwide excluding USA

Annual benefits

Up to the maximum amount per beneficiary per period of cover

SILVER:$1.000.000 / €800.000

GOLD: $2.000.000 / €1.600.000

PLATINUM:unlimited

2. ADD OPTIONAL MODULE

International Outpatient

More extensive outpatient care for treatments that don’t require an overnight stay in hospital. Including prescribed outpatient drugs and dressings and much more.

Annual Benefit

SILVER:$10.000 / €7.400

GOLD: $25.000 / €18.500

PLATINUM:unlimited

Proactively manage your own health. Screen against disease, test against common illnesses and get reassurance with routine physical exams.

Medical evacuation in the event that treatment is not available locally in an emergency, as well as repatriation, allowing the beneficiary to return to their country of habitual residence or nationality.

International Vision & Dental

Vision care including an eye test and a wide range of preventative, routine and major dental treatments

3. MANAGE YOUR PREMIUM

Choose if you would like to add a deductible or cost share.

4 PAY FOR YOUR PLAN

You can choose to pay for your premiums on a monthly, quarterly, or annual basis. You can make payments by debit or credit card, or alternatively if you pay annually, you can pay by bank wire transfer.

![]()

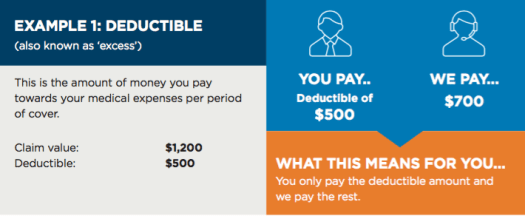

DEDUCTIBLE

Our wide range of deductible and cost share options allow you to tailor your plan to suit your needs.

You can choose to have a deductible and / or cost share on the International Medical Insurance and / or International Outpatient option. No deductible applies to inpatient cash benefits or newborn care benefits.

You will be responsible for paying the amount of any deductible and cost share directly to the hospital, clinic or medical practitioner. We will let you know what this amount is. If you select both a deductible and a cost share, the amount you will need to pay due to the deductible is calculated before the amount you will need to pay due to the cost share. The out of pocket maximum is the maximum amount of cost share any beneficiary must pay per period of cover.

The following examples show how the deductible, cost share and out of pocket maximum work.

COST SHARE + OOP

Cost share is the percentage of every claim you will pay. Out of Pocket (OOP) is the maximum amount you would have to pay in cost share per period of cover.

Benefits

see the details of benefits in the PDF-Leaflet

get QuoteFollowing is the example of 30-year-old staying in Germany

■ First you choose core plan and deductible.

■ choose options next.

Get Quote and apply

It’s just easy to make your own plan and get quotes. Click the button below.

get Quote and apply